On today’s show, we discuss:

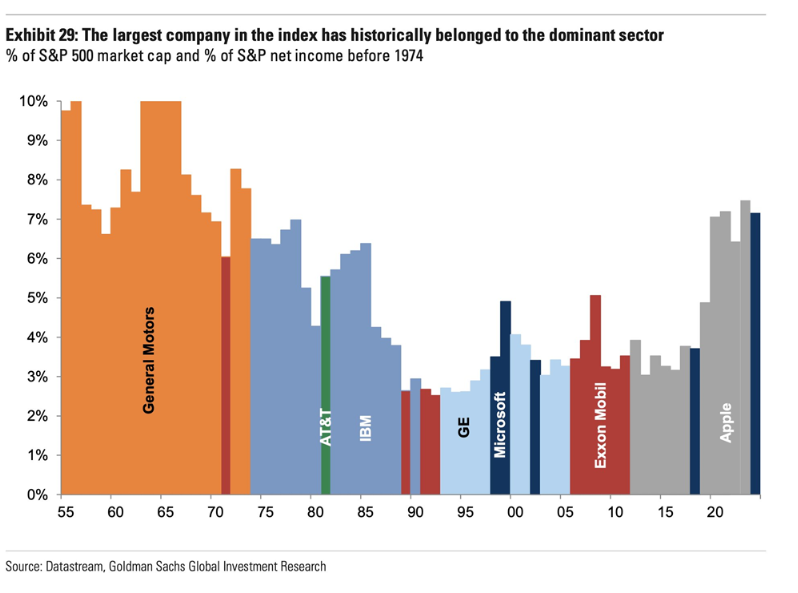

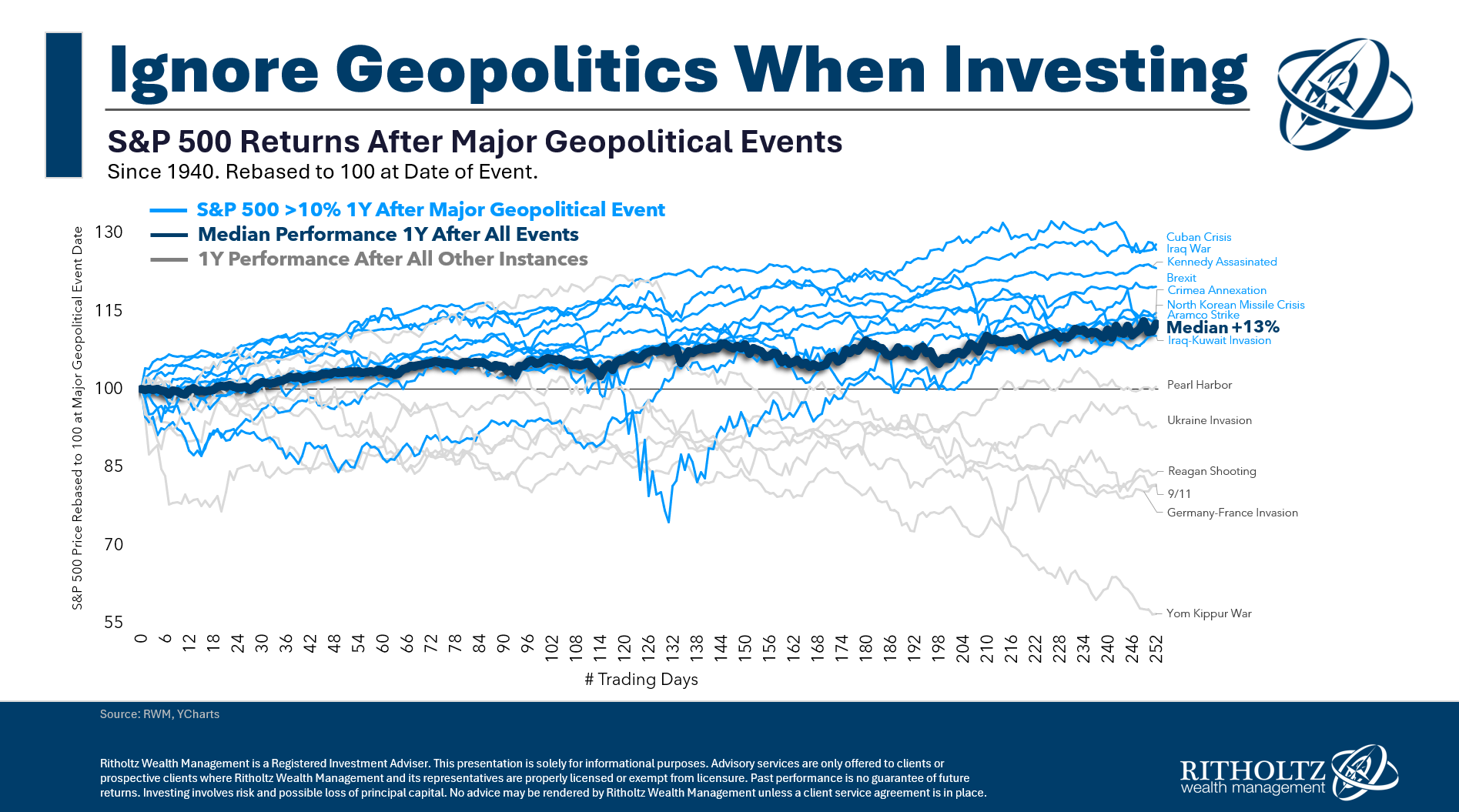

– Why the stock market needed a correction

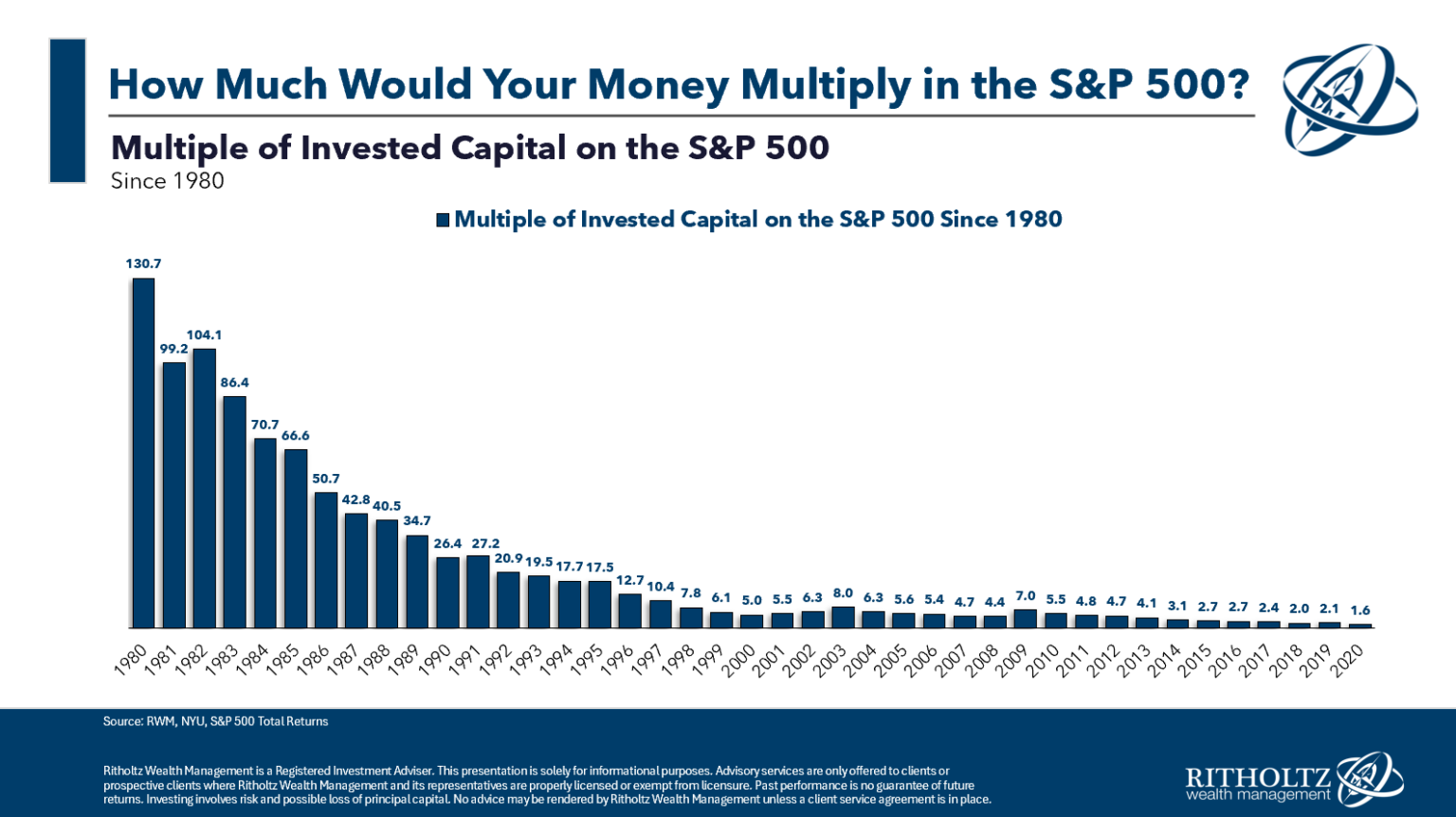

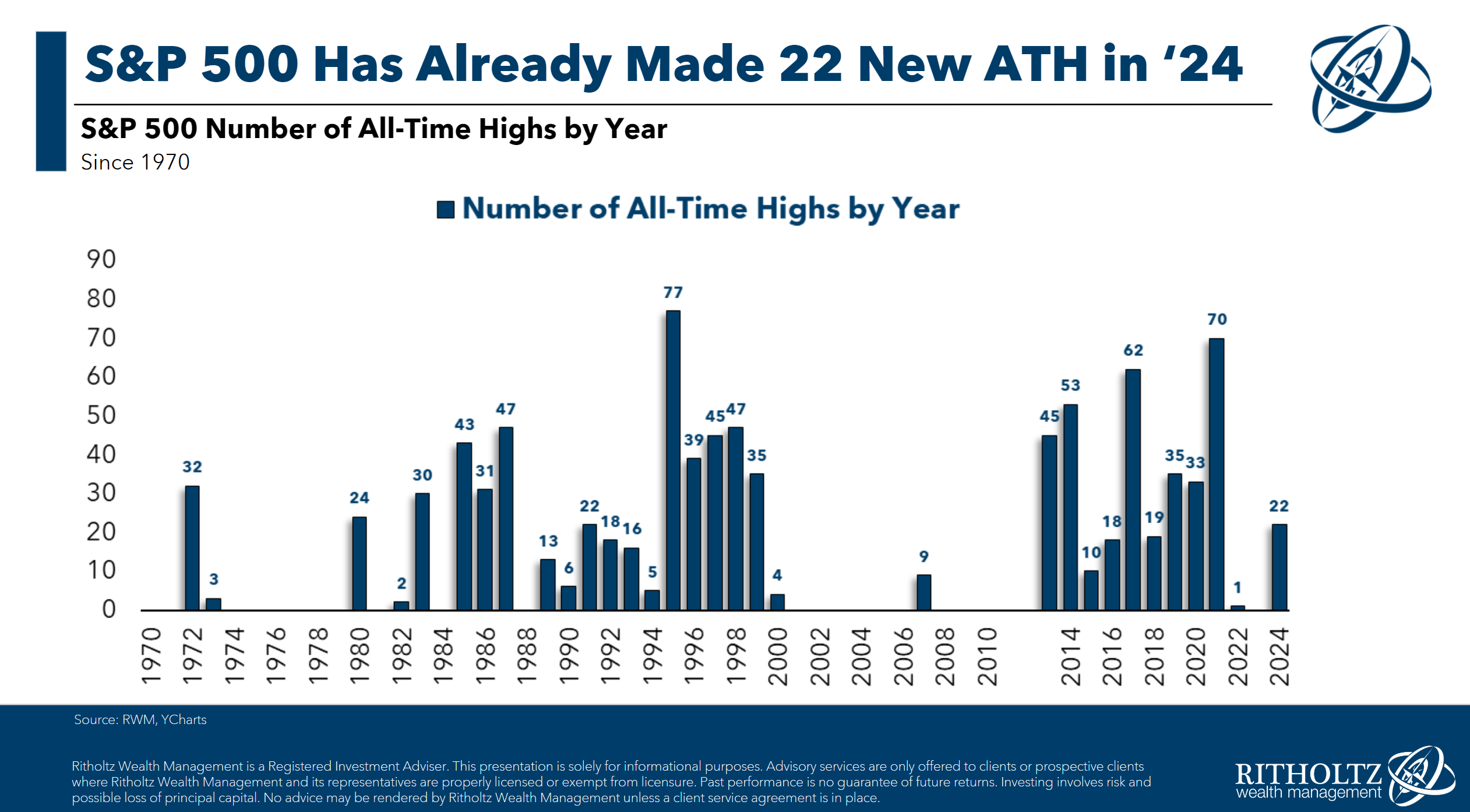

– Why the 1990s is an outlier (in more ways than one)

– Economic growth is a policy choice

– Gen Z is doing better than you think

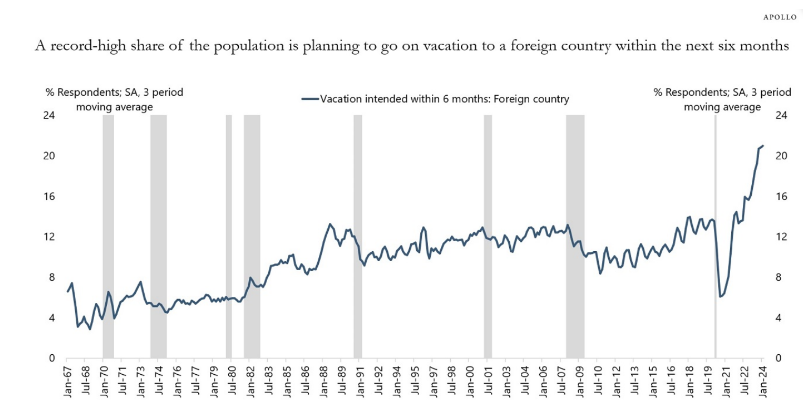

– Living in the U.S. vs. Europe

– The number of households with a paid off mortgage

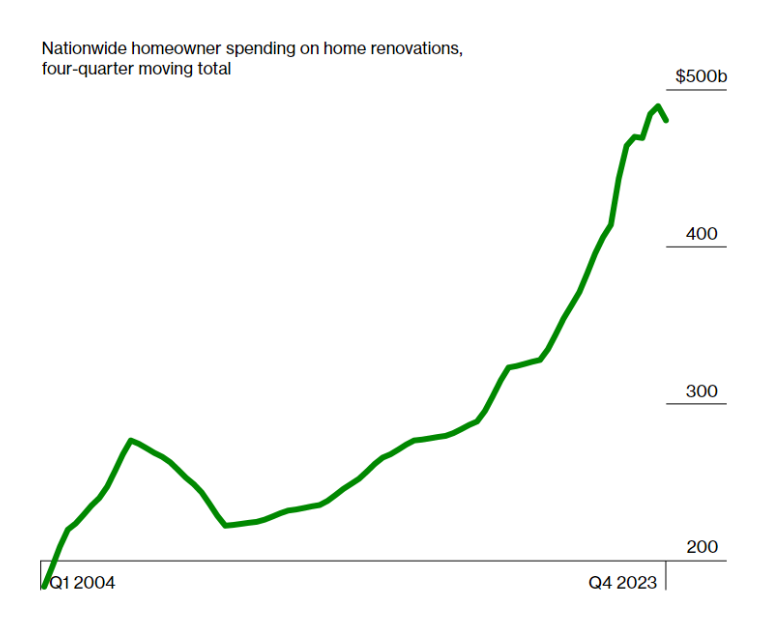

– The renovation boom, and much more!